Real estate can be an effective way for investors to hedge against inflation and potentially generate big returns. Buying physical property can be difficult and expensive for individual investors, but those investors can easily invest in real estate by buying shares of real estate investment trusts, or REITs.

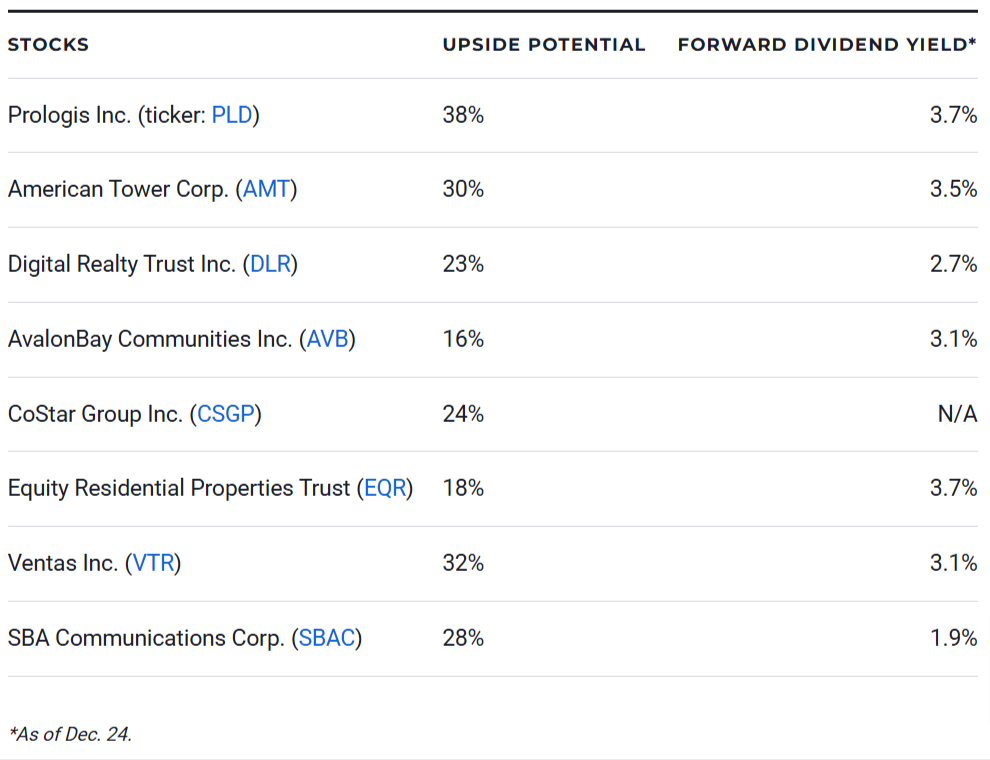

There are several types of REITs, but they all pay dividends. In addition to REITs, the real estate sector includes management and development stocks that may not actually own properties. Here are eight of the best real estate stocks to buy in 2025, according to CFRA analysts:

Prologis Inc. (PLD)

Prologis is an industrial REIT that specializes in logistics real estate. The REIT is down 22% this year through Dec. 23, the worst 2024 performance of any stock on this list. However, analyst Nathan Schmidt says Prologis has a unique portfolio of highly desirable properties in key locations, many of which have high barriers to entry for competitors thanks to zoning restrictions. Schmidt estimates Prologis’ land bank has roughly $40 billion in value creation potential over time. He says Prologis should maintain pricing power as supply growth slows in 2025. CFRA has a “buy” rating and $144 price target for PLD stock, which closed at $104.14 on Dec. 23.

American Tower Corp. (AMT)

American Tower is a specialized REIT that operates the world’s largest independent portfolio of wireless communications and broadcast towers. Schmidt says risks of a potential recession and a slowdown in telecommunication spending are fully priced into American Tower shares at current levels, creating potential for valuation upside in 2025. He says trends such as unlimited data plans, mobile video streaming and 5G band buildouts will support tower demand in the long term. Finally, Schmidt says American Tower has significant growth opportunities in international markets. CFRA has a “buy” rating and $240 price target for AMT stock, which closed at $184.38 on Dec. 23.

Digital Realty Trust Inc. (DLR)

Digital Realty Trust is a specialized REIT that provides data center, co-location and interconnection solutions. Digital Realty shares are up 32% this year, the best 2024 performance of any stock on this list. Analyst Kenneth Leon says Digital Realty is one of the few real estate companies that could be a major winner from the boom in AI technology investment. Leon says AI growth will support demand for data centers, as well as co-location and interconnection solutions. Cloud services growth and the digital transformation are additional tailwinds. CFRA has a “buy” rating and $220 price target for DLR stock, which closed at $178.47 on Dec. 23.

AvalonBay Communities Inc. (AVB)

AvalonBay Communities is a multifamily residential REIT that specializes in upscale apartment communities. Leon says AvalonBay’s portfolio is largely insulated from the problematic Sun Belt region, where new supply is creating rate pressures and cost issues. He says AvalonBay’s Class A properties in coastal markets reap the benefits of sky-high local housing prices, which prevent many renters from buying. In fact, AvalonBay estimates single-family homeownership costs roughly $2,000 per month more than renting in its primary markets, a dynamic which will support rental demand. CFRA has a “buy” rating and $258 price target for AVB stock, which closed at $221.67 on Dec. 23.

CoStar Group Inc. (CSGP)

CoStar is a real estate services company that operates online real estate marketplaces and provides research for the commercial real estate industry. The company’s platforms include STR, Homes.com and Apartments.com. Schmidt says CoStar’s business model is resilient throughout the ups and downs of the business cycle, potentially making the stock a solid defensive investment. He says Homes.com growth will exceed expectations as its user base expands. In addition, Schmidt says CoStar’s customers see the company’s database as indispensable, giving the company significant pricing power. CFRA has a “buy” rating and $90 price target for CSGP, which closed at $72.74 on Dec. 23.

Equity Residential Properties Trust (EQR)

Equity Residential is a multifamily residential REIT that owns and operates a diversified portfolio of apartment properties. Leon says Equity’s markets have a more affluent renter base than most markets targeted by other REITs, particularly those focused on the Sun Belt region. He says many of Equity’s markets will rebound in 2025. In particular, he says job growth will help support rental demand in the key markets of Seattle and San Francisco. CFRA has a “buy” rating and $84 price target for EQR stock, which closed at $71.44 on Dec. 23.

Ventas Inc. (VTR)

Ventas is a health care REIT that specializes in health care facilities, including specialty care facilities, housing for seniors, medical office buildings and hospitals. Schmidt says high-quality senior housing could be in the early innings of a decade-long demand boom as the baby boomer generation matures. In fact, he estimates the number of Americans age 80 or higher will grow at a 4.4% annual rate through 2030. At the same time, low senior housing inventory growth has constrained supply, helping support occupancy and rental rates. CFRA has a “buy” rating and $78 price target for VTR stock, which closed at $58.93 on Dec. 23.

SBA Communications Corp. (SBAC)

SBA Communications is a specialized REIT that owns and operates a global wireless communications tower network. Schmidt says SBA shares are attractively valued, trading at a significant discount relative to the REIT’s historical earnings multiple. He says the current climate for tower REITs is far from ideal, but industry headwinds will likely subside in 2025 as the Federal Reserve cuts interest rates further. Even in a challenging market, Schmidt says SBA has consistently generated cash flow margins above 80% and returns on invested capital above 10%. CFRA has a “buy” rating and $260 price target for SBAC stock, which closed at $203.28 on Dec. 23.