While many investors can get caught up on the day-to-day gyrations of the stock market, finding the best long-term stocks can provide very impressive returns. And more importantly, picking stocks to buy and hold for the long haul can give investors peace of mind as they do not have to worry about chasing the latest fads or headlines.

There are no sure things on Wall Street, of course, and a lot can happen over a decade or two. But the following seven companies are large and entrenched leaders valued at $70 billion or more, and all have consistent track records of strong performance.

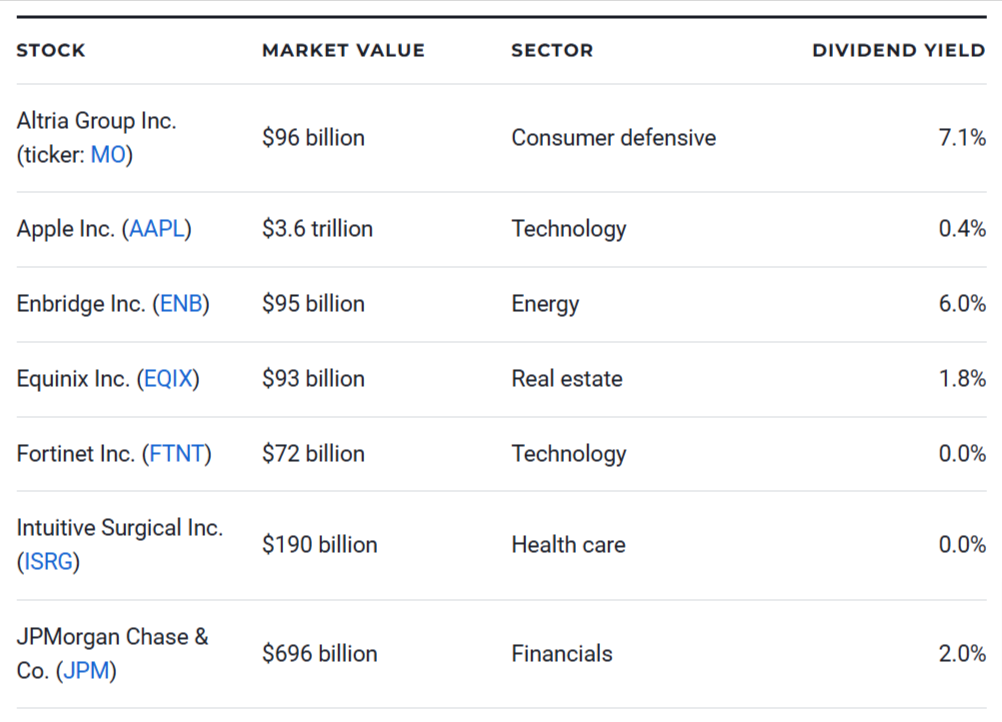

Here are seven of the best long-term stocks to buy:

Altria Group Inc. (MO)

Market value: $96 billion

Sector: Consumer defensive

The tobacco giant behind Marlboro cigarettes, Black & Mild cigars and Skoal smokeless tobacco, Altria is a stable blue-chip dividend stock with staying power. Altria products admittedly aren’t particularly healthy, but the tobacco biz features reliable sales and loyal customers. Furthermore, if MO stock can deliver long-term returns despite changing public perceptions about smoking and prominent litigation over the last several decades, that should give long-term investors plenty of confidence about the future. Altria has logged 55 consecutive years of dividend increases, and currently features one of the most generous payouts on Wall Street at 7.1%. That income stream is yet another reason to consider MO as one of the best long-term stocks to buy now.

Apple Inc. (AAPL)

Market value: $3.6 trillion

Sector: Technology

As the largest U.S. corporation by market value and a brand that is synonymous with mobile devices, Apple is perhaps the most entrenched technology firm on the planet. As a marker of just how large it is, consider the firm has roughly $65 billion in cash and short-term investments as it enters 2025 – enough to purchase other iconic large-cap brands such as General Motors Corp. (GM) or Target Corp. (TGT) outright if it really wanted to. Shares are up more than 250% in the last five years and have consistently outperformed the S&P 500 over the long haul thanks to a powerful product line and a loyal customer base.

Enbridge Inc. (ENB)

Market value: $95 billion

Sector: Energy

It’s no easy task to identify energy stocks with staying power in an age of climate change and volatile commodity prices. But as the largest midstream energy stock out there, Enbridge is uniquely positioned for stable long-term returns regardless of other disruptions in the sector. Its business model is focused on energy infrastructure with more than 18,000 miles of active pipelines used by third parties to transport oil and gas. In other words, it’s more of a toll taker along the supply chain instead of a driller or a refiner. This more consistent focus in the energy sector makes it a reliable dividend payer, with a generous yield of 6% at present and consistent operating performance that makes it one of the best long-term stocks to buy.

Equinix Inc. (EQIX)

Market value: $93 billion

Sector: Real estate

A unique play on the tech sector, Equinix is a real estate investment trust, or REIT, that specializes in digital infrastructure such as data centers and related facilities. Remote corporate servers and cloud computing functionality require physical computers to be located somewhere, after all, and EQIX has properties that do this at scale for leading health care companies, financial firms, online retailers and others. All in all, it has about 3,500 tenants to provide a diverse revenue stream – and in a digital age, chances are these companies are only going to need more data space services in the future. That makes Equinix one of the best long-term stocks to buy now for investors looking to cash in on this trend.

Fortinet Inc. (FTNT)

Market value: $72 billion

Sector: Technology

Gartner analysts have forecast cybersecurity spending will rise about 14% in 2025, marking yet another year of double-digit growth. And as one of the largest and most dominant companies in the industry, Fortinet is a natural beneficiary of this long-term megatrend that is lifting cybersecurity stocks. The firm logged about $2.6 billion in revenue back in fiscal 2020, and in fiscal 2025 it is predicted to rake in $6.6 billion for a 154% growth rate over the last five years. Share prices have been on an equally impressive run, too, posting roughly 360% gains in the same five-year period. With recurring subscription charges providing a steady and reliable stream of cash, coupled with continued expansion and growth for the sector, the long-term outlook of FTNT is bright.

Intuitive Surgical Inc. (ISRG)

Market value: $190 billion

Sector: Health care

Though perhaps not the first name that comes to mind in the health care sector, Intuitive Surgical is a stock with a tremendous track record of long-term success and innovation. ISRG has helped revolutionize surgery through robotic assistance and high-tech tools that reduce errors by doctors and speed patient healing. The stock is up about 175% in the last five years and up an amazing 850% or so in the last decade. While major drug companies have to constantly fend off patent expirations, the moat around Intuitive Surgical’s business comes from its high-tech expertise, the trust it has won in the medical community and continued improvements that make its hardware indispensable in hospitals worldwide. The next blockbuster drug may be hard to predict, but continued success for ISRG stock seems a pretty safe bet.

JPMorgan Chase & Co. (JPM)

Market value: $696 billion

Sector: Financials

JPMorgan is a global financial leader with almost $4 trillion in assets under management, making it the largest bank in the world when you exclude the four state-owned megabanks in China. The firm has weathered a host of economic challenges since its corporate roots in 1799, including most recently capitalizing on regional banking uncertainty to acquire First Republic Bank in 2023 after the second-largest bank failure in U.S. history. JPM added half a million customers to its rolls at fire-sale prices, proving yet again the long-term benefits of being the biggest and most respected institution out there.